Ever since the US CPA exam is available in Middle East, the number of CPA candidates in the region has increased greatly. This article focuses on aspiring CPA in Dubai and UAE, their pass rates, and how they have been performing.

The following analysis is based on 2013 data from NASBA. I will update with 2015 figures as soon as they are available.

UAE CPA Exam Candidate Pass Rates

There were 581 candidates applied directly from UAE. The average age was 31.6 which is a couple of years old than the global average.

First Timers vs Retakers

Similar to the global trend, around 60% of UAE candidates took the exam for the first time. They had an overall 42% pass rate, which is quite a bit higher than the retaker’s at 36%.

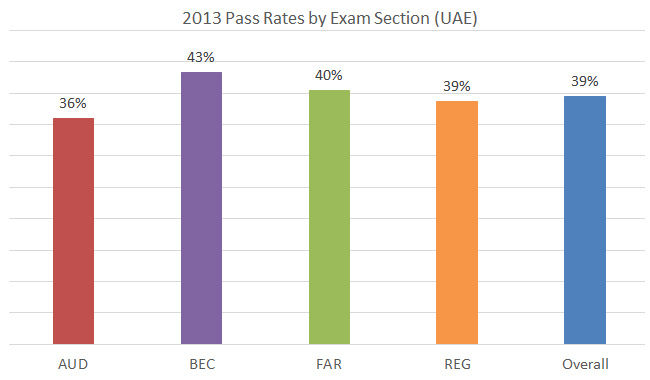

Pass Rates by Exam Section

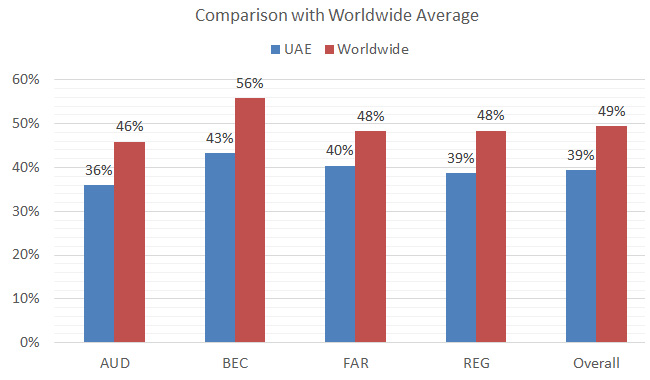

BEC results were the best at 43% pass rate; AUD the worst at 36%. BEC and AUD were also the best/worst on a global scale but the difference is smaller, as shown in the second chart.

The UAE pass rates across exam sections were lower than the global average by 8-13 percentage point. The language is likely a big part of it. We will take a closer look at the performance by part at the end of this post.

Pass Rates by Age

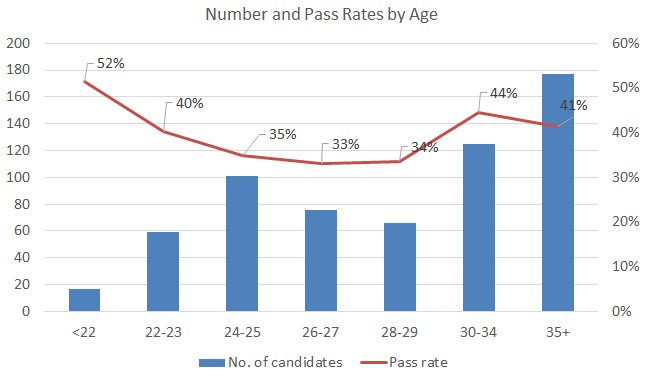

(x-axis: age in terms of number of years; y-axis: number of candidates)

Looking at the pass rates by age, those who were 22 years old or below did particularly well, although not sure if this is statistically significant given the small sample.

There were also quite a lot of candidates in their early to mid thirties taking the exam. Interestingly, those in their 30s had higher pass rates.

It is hard to generalize but possible reasons include having a higher degree in relevant field, or that they have more experience which helps in scenario-type simulations.

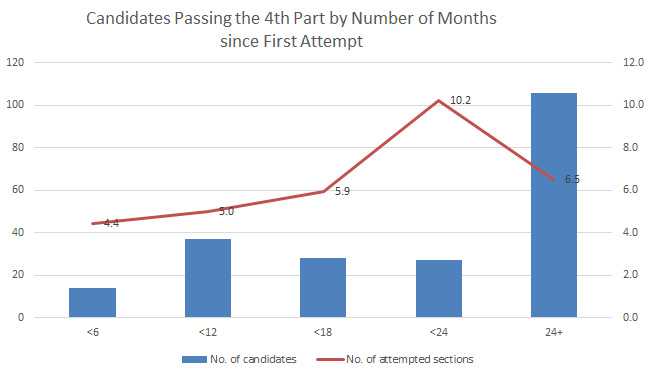

(x-axis: number of months since first attempt;

left y-axis: number of candidates; right y-axis: number of attempted sections)

Among those who passed the 4th part (i.e. completing the exam), most candidates took more than 24 months to reach this goal. This means that many have the experience of losing credits after the 18-month window but still hang on.

On average, it takes UAE candidates 6.5 attempts to complete the CPA exam, meaning 4 success passes and 2.5 retakes. This is in line with the global average of 6.6 attempts.

FAR Performance by Content Area

Now, let’s take a look at the results by part. The following charts show the percentage of “comparable” or “stronger” on the candidates’ score report. You can see this as an indication similar to pass rates.

| Content Area | Stands for: | Weighting |

| Frm Std | Framework and standards | 17-23% |

| Fin Sta | Financial statement accounts | 27-33% |

| Spc Trn | Specific transactions / events | 27-33% |

| Govt | Governmental accounting | 8-12% |

| NFP | Not-for-profit accounting | 8-12% |

The weaker performance in financial statement and specific transaction may due to the relative unfamiliarity of US GAAP. The rest are more or less in line with global average.

Task-based simulations is definitely the area to work on for FAR. Since sims represents 40% of the exam, make sure you get enough practice.

AUD Performance

| Content Area | Stands for: | Weighting |

| Un Eng | Understanding the engagement | 12-16% |

| Un Ent | Understanding the entity | 16-20% |

| Pro Evi | Procedure and evidence | 16-20% |

| Evi Rpt | Evaluation and reporting | 16-20% |

| Acct Rev | Accounting and review services | 12-16% |

| Pro Res | Professional responsibilities | 16-20% |

Performance of the 6 AUD subjects vary considerably. UAE candidates seem to be better in theoretical areas, such as “understanding engagement” (the first part of the audit procedure), and less so on the more analytical area, such as “procedure and evidence”.

It does not necessarily mean that these candidates are weaker in audit analytical skills. Some of the AUD questions are often tricky with more than one correct answer, and candidates have to pick the best one.

If candidates attend local coaching classes and learn the concepts in a language other than English, then during the actual exam, they may have difficulty understanding these lengthy and tricky questions.

REG Performance

| Content Area | Stands for: | Weighting |

| Eth Leg | Ethics and legal responsibilities | 15-19% |

| Bus Law | Business law | 17-21% |

| Fed Tx | Federal tax process | 11-15% |

| Tx Pro | Taxation on property transactions | 12-16% |

| Tx Ind | Taxation on individuals | 13-19% |

| Tx Ent | Taxation on entities | 18-24% |

Considering US taxation is completely foreign to UAE candidates, they did well overall. I am especially impressed by business law results: at 65%, it is higher than the global average of 61%.

Again, the one area that candidates should work on for REG is task-based simulations. REG sims is believed to be the hardest, so don’t feel frustrated if you need a lot of time to work through them.

BEC Performance

| Content Area | Stands for: | Weighting |

| Crp Gov | Corporate governance | 16-20% |

| Eco Con | Economics concepts and analysis | 16-20% |

| Fin Mgt | Financial management | 19-23% |

| Info Sys | Information systems | 15-19% |

| Str Plan | Strategic planning | 10-14% |

| Op Mgt | Operations management | 12-16% |

BEC also scores quite well in terms of the actual results and relative to the global average. The areas that are slightly below average are Corporate Governance and Information Systems. Strategic Planning, which is mainly cost accounting, was above average.

Written communications represent only 15% but the UAE vs global discrepancies is big: UAE at 48% vs global at 70%. The chance of passing would be a lot higher if they are able to close the gap.

What Does It Mean to You

5 takeaways:

- Work on Simulations

- Work on your English business writing

- People on average need 6.5 attempts to pass. Don’t give up!

More Resources for Aspiring CPA in Dubai and UAE

- How do I register and take the exam in the Middle East test centers?

- CPA exam application process at a glance

- Accounting salary trend in UAE (based on IMA survey)

Data Source

Read US CPA in Dubai: Pass Rates and Candidate Performance Analysis on I Pass the CPA Exam!!